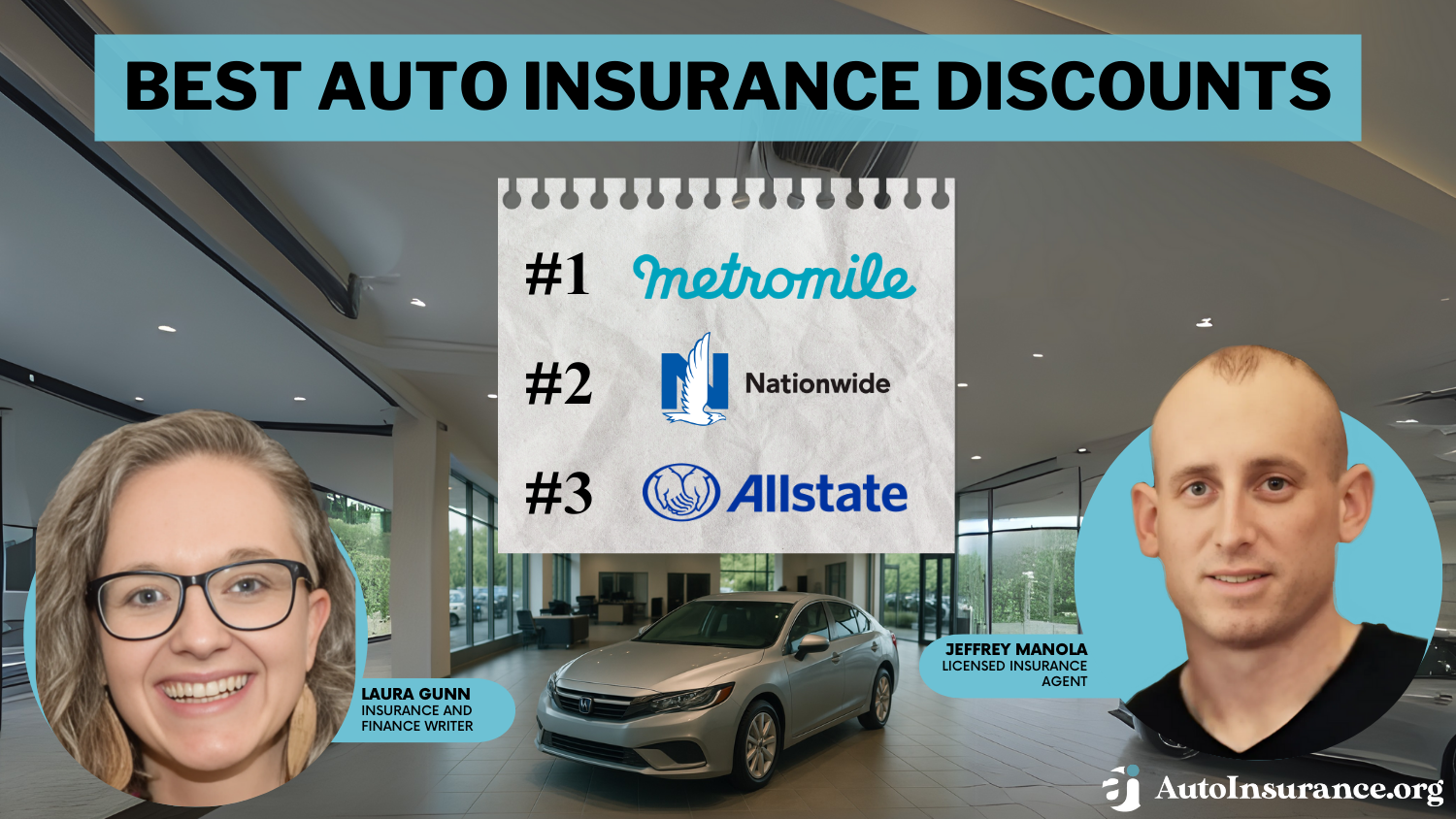

Best Auto Insurance Discounts in 2025 (Save up to 40% With These 10 Companies)

Drivers can save up to 40% with the best auto insurance discounts from top companies like Metromile, Geico, and State Farm. Metromile stands out with its pay-per-mile program, ideal for low-mileage drivers seeking significant auto insurance discounts while only paying for the coverage they need.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Unlocking the Best Auto Insurance Discounts is all about knowing the tricks of the trade. Insurers often offer discounts of up to 40%, rewarding safe driving, bundling policies, and maintaining a good credit score.

You can boost these savings even further by raising your deductibles and shopping around for competitive rates and the best auto insurance companies offer various ways to save.

Our Top 10 Company Picks: Best Auto Insurance Discounts

Company Rank A.M. Best Savings

PotentialWho Qualifies?

#1 A- 40% Low-mileage drivers

#2 A+ 30% SmartRide users

#3 A+ 25% Drivewise enrollees

#4 A 25% RightTrack users

#5 A++ 20% Drive Safe & Save users

#6 A+ 20% Snapshot users

#7 A++ 15% DriveEasy users

#8 A 15% KnowYourDrive users

#9 A++ 10% IntelliDrive users

#10 A 10% RightTrack users

Master these strategies to maximize your discounts and keep your premiums low.

Enter your ZIP code into our free quote tool above to instantly see how auto insurance discounts can impact your monthly premium.

- Discounts can lower your rates by up to 40%

- Insurers offer discounts based on the driver, policy, and car safety features

- Bundle all discounts available to you for the most savings

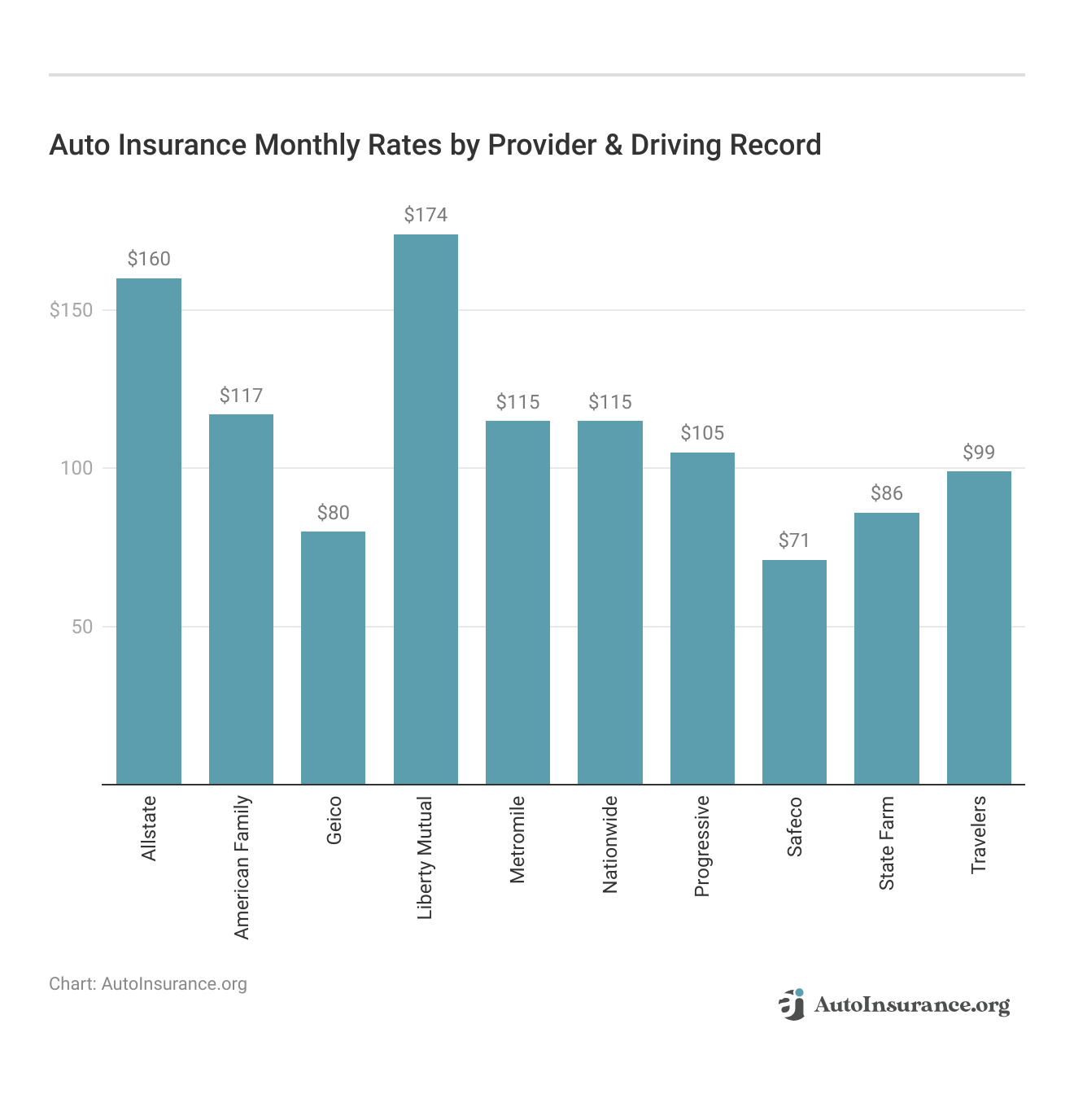

Auto Insurance Monthly Rates by Provider & Driving Record

Auto insurance rates vary significantly depending on the provider and your driving record. Insurance companies assess factors such as past driving behavior and offer various discounts that can influence monthly premiums. Finding the best auto insurance discounts whether for safe driving, bundling policies, or low mileage can greatly reduce your insurance costs, making it easier to manage your budget.

Your driving record plays a crucial role in shaping auto insurance rates, but combining it with the right discounts can lead to significant savings.

By comparing rates and taking advantage of the best auto insurance discounts available in 2024, such as those for safe driving or policy bundling, you can secure quality coverage at an affordable price, ensuring you’re well-protected on the road while minimizing expenses.

For further details, see our guide titled, “Auto Insurance and Driving Laws.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Common Types of Auto Insurance Discounts

You may be wondering “How can I lower my auto insurance rate?” While there are various factors that affect insurance rates, the best auto insurance companies reward extra savings to drivers with specific characteristics through discounts.

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

auto insurance savings vary based on the driver, policy, and vehicle. Since so many automobile insurance discounts are available, most drivers can save considerably on their policies.

Fortunately, there are numerous discounts available that you can take advantage of when it comes to auto insurance.

Most Common Auto Insurance Discounts

| Vehicle Discounts | Driver Discounts | Personal Discounts |

|---|---|---|

| Active Disabling Device | Claim Free | Emergency Deployment |

| Adaptive Cruise Control | Continuous Coverage | Family Legacy |

| Adaptive Headlights | Defensive Driver | Family Plan |

| Anti-Lock Brakes | Driver's Education | Federal Employee |

| Audible Alarm | Driving Device/App | Further Education |

| Automatic Braking | Early Signing | Good Student |

| Blind Spot Warning | Full Payment | Homeowner |

| Daytime Running Lights | Good Credit | Life Insurance |

| Economy Vehicle | Loyalty | Married |

| Electronic Stability Control | Multiple Policies | Membership/Group |

| Farm/Ranch Vehicle | Multiple Vehicles | Military |

| Forward Collision Warning | New Customer/New Plan | New Address |

| Garaging/Storing | Occasional Operator | New Graduate |

| Green/Hybrid Vehicle | Online Shopper | Non-Smoker/Non-Drinker |

| Lane Departure Warning | On-Time Payments | Occupation |

| Newer Vehicle | Paperless/Auto Billing | Recent Retirees |

| Passive Restraint | Paperless Documents | Stable Residence |

| Utility Vehicle | Roadside Assistance | Student Away |

| Vehicle Recovery | Safe Driver | Student or Alumni |

| VIN Etching | Seat Belt Use | Volunteer |

Remember that each insurance company chooses what types of auto insurance discounts to offer and the savings amount. So while one company may offer a 25% automobile insurance discount, another company may only provide a 10% savings or no discount at all.

In addition, each company determines when you’re eligible for auto insurance savings. For example, you may have to be with the company for several years to qualify for auto insurance deals based on loyalty.

Auto Insurance Discounts From Top Providers

| Discount Name | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | X | X | 10% | 10% | 5% | 3% | X | 7% | 10% | X |

| Adaptive Headlights | 15% | 15% | 10% | 5% | 5% | 10% | 15% | 5% | 5% | 15% |

| Anti-Lock Brakes | 10% | 10% | 10% | 5% | 5% | 5% | 10% | 5% | X | X |

| Anti-Theft | 10% | X | X | 23% | 20% | 25% | 20% | 15% | X | X |

| Claim Free | 35% | 10% | 15% | 26% | 15% | 10% | 15% | 15% | 23% | 12% |

| Continuous Coverage | X | 10% | 10% | X | 15% | 15% | 10% | 10% | 15% | 5% |

| Daytime Running Lights | 2% | X | 2% | 3% | 5% | 5% | 7% | 3% | X | X |

| Defensive Driver | 10% | 10% | X | 10% | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | 15% | 30% | 30% | 20% | 10% | 20% | 20% | 7% | X |

| Driver's Education | 10% | 10% | 8% | X | 10% | 8% | 10% | 15% | 8% | 3% |

| Early Signing | 10% | 12% | 15% | 15% | 8% | 8% | 8% | 15% | 10% | 12% |

| Electronic Stability... | 2% | 3% | 3% | 2% | 5% | X | 5% | X | 3% | 2% |

| Emergency Deployment | 5% | X | 20% | 25% | X | X | X | X | 20% | 25% |

| Engaged Couple | 10% | 10% | 5% | X | 5% | 10% | 5% | X | X | 10% |

| Family Legacy | X | 10% | X | 5% | 10% | 5% | 5% | X | 5% | 10% |

| Family Plan | 20% | X | 15% | X | 10% | 25% | X | 15% | 15% | X |

| Farm Vehicle | 10% | X | 10% | X | 10% | 5% | X | 5% | 10% | X |

| Fast 5 | X | X | X | X | X | X | X | X | X | X |

| Federal Employee | 13% | 15% | X | 12% | 10% | 16% | X | 15% | X | X |

| Forward Collision Warning | 5% | 10% | 5% | 10% | 5% | X | 5% | 5% | 5% | 10% |

| Full Payment | 10% | 10% | 8% | X | $50 | 8% | 10% | X | 8% | X |

| Further Education | X | X | X | X | 10% | 15% | X | X | X | X |

| Garaging/Storing | X | X | X | X | X | X | X | X | X | 90% |

| Good Credit | 10% | X | 5% | 10% | 5% | X | 10% | X | 10% | X |

| Good Student | 20% | 23% | X | 15% | 23% | 10% | 8% | 25% | 8% | 3% |

| Green Vehicle | 10% | X | 5% | X | 10% | X | X | 10% | 10% | X |

| Homeowner | 3% | 3% | 5% | X | 5% | 5% | X | 3% | 5% | X |

| Lane Departure Warning | X | X | X | X | X | X | X | X | X | X |

| Low Mileage | 30% | 30% | 25% | 25% | 30% | 25% | X | 25% | 30% | 25% |

| Loyalty | 5% | 15% | 5% | X | 15% | 5% | 15% | 15% | 5% | X |

| Married | 5% | X | 5% | X | X | X | 5% | X | X | X |

| Membership/Group | X | 7% | X | X | 10% | 7% | X | X | X | 7% |

| Military | X | X | 15% | 15% | 4% | 10% | X | X | X | 30% |

| Military Garaging | X | X | X | X | X | X | X | X | X | 15% |

| Multiple Drivers | 25% | 20% | 20% | X | X | 25% | X | X | 25% | X |

| Multiple Policies | 10% | 29% | 20% | 10% | 20% | 10% | 12% | 17% | 13% | X |

| Multiple Vehicles | X | 10% | 8% | 25% | 10% | 20% | 10% | 20% | 8% | X |

| New Address | X | 5% | X | X | 5% | 5% | X | 5% | X | X |

| New Customer/New Plan | X | X | X | X | X | X | X | X | X | X |

| New Graduate | 5% | 15% | 10% | X | 5% | 15% | 10% | 5% | 15% | 10% |

| New Vehicle | 30% | X | 30% | 15% | 40% | X | 40% | 10% | 12% | X |

| Newly Licensed | X | X | X | X | 5% | X | X | X | X | X |

| Newlyweds | 10% | X | 5% | 5% | 5% | X | 10% | X | 10% | X |

| Non-Smoker/Non-Drinker | X | X | 10% | X | 10% | 10% | X | X | X | 10% |

| Occasional Operator | X | X | X | X | X | X | X | X | X | X |

| Occupation | X | X | X | X | 10% | 15% | X | X | X | X |

| On-Time Payments | 5% | 10% | X | 10% | 10% | 15% | 15% | X | 15% | X |

| Online Shopper | 10% | X | X | X | 10% | X | 7% | X | 10% | X |

| Paperless Documents | 10% | 5% | X | 5% | 5% | 5% | $50 | 10% | 5% | 10% |

| Paperless/Auto Billing | 5% | 5% | X | X | 3% | $30 | X | $20 | 3% | 3% |

| Passive Restraint | 30% | 30% | X | 40% | X | 20% | X | 40% | X | X |

| Recent Retirees | X | X | X | X | 4% | X | X | X | X | X |

| Renter | X | X | X | X | X | X | X | X | X | X |

| Roadside Assistance | X | X | X | X | X | X | X | X | X | X |

| Safe Driver | 45% | X | X | 15% | X | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | X | X | X | 15% | X | X | X | X | X | X |

| Senior Driver | 10% | X | X | X | X | X | X | X | X | X |

| Stable Residence | X | X | X | X | X | X | X | X | X | X |

| Students & Alumni | X | X | X | X | 10% | 7% | X | X | X | X |

| Switching Provider | X | X | X | X | 10% | X | X | X | X | X |

| Usage-Based Discount | 20% | 40% | 20% | X | 30% | 40% | $231/yr | 50% | 30% | 5% |

| Utility Vehicle | 15% | X | X | X | X | X | X | X | X | X |

| Vehicle Recovery | 10% | X | X | 15% | 35% | 25% | X | 5% | X | X |

| VIN Etching | X | X | X | X | 5% | X | X | X | X | X |

| Volunteer | X | X | X | X | X | X | X | X | X | X |

| Young Driver | X | X | X | X | X | X | X | X | X | $75 |

When you shop for auto insurance, compare discounts, rates, and coverages. Discount auto insurance rates may make the difference in which company is cheaper for you.

Research the most common auto insurance discounts to have an idea of what to expect. Figure out how to get discounts on auto insurance by reaching out to the companies directly, or looking at a list of auto insurance discounts.

Now we’ll look at the categories of auto insurance discounts potentially available to you. Keep reading for find your best auto insurance discounts and learn how to save money on auto insurance premiums. For more information, check out our complete guide titled, “How to Get an Anti-Lock Brakes Auto Insurance Discount.”

Driver-Related Auto Insurance Discounts

Your personal characteristics may help you find discount auto insurance. Everything from your driving record to where you work can save you money. Auto insurance companies offer savings for traits that make you a safer driver and save them money.

Let’s look at some driver-related discounts and how you can take advantage of them.

Safe Driver Auto Insurance Discount

It’s not a surprise that your driving record affects your auto insurance rates. Drivers with accidents, tickets, or DUIs pay much higher rates than drivers with clean record. Learn how auto insurance companies check driving records here.

Additionally, your driving record can earn you up to a 35% good driver discount on auto insurance. A discount of this caliber also shows this to be one of the best auto insurance discounts available.

Drivers who stay accident or claims-free for some time earn significant discounts since they’re less likely to cost the insurance company, including possible auto insurance safety discounts. The amount of time you must be accident-free and the safe driver discount amount varies by company.

However, don’t worry if your driving record isn’t clear. In most states, accidents and tickets stop affecting auto insurance rates in three to five years.

So, avoid adding dings to your driving record to get lower auto insurance rates and earn a significant safe driver discount.

There are also safety features that lower autoinsurance with many companies, such as telematics. Having a telematics insurance discount, such as Drive Safe & Save™ with State Farm, can lower monthly costs as well as premiums. Devices and apps allow for auto insurance savings based on tracked safe driving habits.

Defensive Driving Course Auto Insurance Discount

Defensive driving course requirements vary by state but typically teach essential, safe driving skills, such as how to drive in bad weather, avoid road rage, and the dangers of distracted driving. You can also earn a defensive driver auto insurance discount to lower your rates upon completion of a defensive driving course.

An important reason why you should take a defensive driving class is because it helps drivers avoid accidents. In addition, some states remove driver’s license points for taking the class, and some also allow you to take the class online at your own pace.

Good Student Auto Insurance Discount

While specifics vary by company, students with a high GPA can earn a good student auto insurance discount. This is one of a few discounts on auto insurance aimed toward young adults, due to notoriously high rates for younger drivers.

You could earn a 25% good student discount on auto insurance for young adults, bringing high coverage rates down to a reasonable cost.

Most insurance companies require the student to maintain at least a B average, be enrolled full-time in high school or college, and be under 25 years of age.

Students who go to college away from home may also qualify for a distant student discount.

Driver’s Education Auto Insurance Discount

Drivers ed teaches new drivers how to drive safely, and most states require underage drivers to complete a course to get a license.

Although driver’s ed is similar to a defensive driving course, it teaches young drivers the rules of the road in addition to safe driving skills. This is one of the less common auto insurance discounts.

Combine your good student and driver’s ed auto insurance discount for significant savings on auto insurance for teens.

Student Away at School Auto Insurance Discount

You might not have been aware that having a child in college could actually help you save on auto insurance. Students away at school without a car earn a discount since they only drive when they’re home.

Although requirements vary, students typically must be enrolled full-time in school at least 75 miles from home and not take a vehicle. In addition, since the student lacks access to a car most of the time, most insurance companies offer significant savings. Learn more about auto insurance for children at college here.

Married Driver Auto Insurance Discount

Auto insurance companies offer an insurance discount for being married since statistics show that they’re less likely to engage in risky behaviors and are safer drivers. In addition, many married couples chose to bundle their policies, resulting in more significant auto insurance savings. Read more about the best auto insurance companies for married couples.

Remember that only about half of the top insurance companies offer a discount for married drivers. So, let your insurance company know if you’ve had significant life events like getting married because you may qualify for additional savings.

Military Auto Insurance Discount

Many auto insurance companies offer discounts of up to 15% for active and retired military members and their families. Expected savings include military, garaging, and deployment discounts.

For example, you can get a Geico discount of 25% if a service member is deployed to an imminent danger area and stores their vehicle.

Although many insurance companies offer military discounts, USAA only provides coverage to military members and their families. So, there isn’t a particular USAA military discount, but our USAA review shows rates are generally much lower with the company, even without a discount.

To discover more about the company, visit our guide titled, “Auto Insurance Discount for Navy Federal Members.”

Disabled Veteran Auto Insurance Discount

A few companies offer disabled veteran auto insurance discounts. This is one of the best auto insurance discounts for seniors. On average, disabled veterans can save 10% on their auto insurance premiums.

Affiliation Auto Insurance Discount

Many insurance companies offer a specialized first responder auto insurance discount, acknowledging the crucial contributions of these dedicated professionals in the community. auto insurance discounts for teachers and first responders are also available, offering them a 15% discount on auto insurance. Learn more about auto insurance for teachers.

Some insurance companies also offer discounts based on the organizations and schools you’re a part of. Examples include AAA, AARP, various colleges, fraternities, sororities, and student organizations.

Looking for the Geico affiliation discount list? Check out our review of “Geico Auto Insurance Discounts” for more details.

Low-Mileage Auto Insurance Discount

You might not have known that not driving often is actually the best way to save on auto insurance.

Some companies also offer up to 30% discounts for low mileage on auto insurance. Insurance companies know that less time on the road means a lower chance of an accident. Read more about auto insurance for infrequent drivers.

So, you might wonder how annual mileage affects auto insurance rates. You must show proof of your mileage every year to qualify for a low-mileage auto insurance discount.

Policy-Related Auto Insurance Discounts

You may also be eligible for discounts based on your policy. So whether you have multiple cars or like to pay your bills online, you can save money.

Every auto insurance company offers various discounts related to your policy, and not all companies offer the same discounts. Most auto insurance policyholders qualify for multiple discounts, such as multi-policy and paperless discounts. Adjust how you pay your bill and when you renew for easy ways to save.

Multi-Vehicle Auto Insurance Discount

Drivers save up to 25% if they insure more than one vehicle with the same company. In addition to getting a multi-vehicle auto insurance discount, it’s also easier to have all of your cars insured together.

Many insurance companies have apps that allow you to access all of your information in one place. Read more about the best auto insurance companies for multi-vehicle households.

Multi-Policy Auto Insurance Discount

Anyone wondering how to reduce auto insurance should consider bundling policies. Insurance companies typically offer many insurance products that allow you to use one company for all your insurance needs.

Many companies offer discounts of up to 25% if you have multiple policies, such as bundling home, auto, boat, and personal liability coverage.

Not only does bundling all of your needs make it easier for you, but the insurer gains more policies. Learn more about how to save money by bundling insurance policies.

With many companies, you save more when you bundle more policies and may get additional savings on your other policies. For example, you can get 25% off of your auto insurance by bundling your home and auto, and you may save on your home insurance too. Multi-policy discounts are typically some of the best auto insurance deals.

Paid-in-Full Auto Insurance Discount

How you pay for auto insurance can also save you money. For example, you may qualify for a discount if you pay in advance or make payments.

So, how do auto insurance payments work? Many auto insurance companies offer a paid-in-full discount of up to 15% for drivers who pay their entire policy at the start. In addition, some companies offer savings if you choose to set up automatic payments throughout your term. However, this is one of those auto insurance discounts to ask for specifically, as it’s not very common

Paying in full also provides the best insurance rates, as taxes and fees are minimal

Read more: How to Get an Electronic Automatic Billing Auto Insurance Discount

Early Signing Auto Insurance Discount

If you renew your policy or start a new one 14 days before your current policy expires, you can get up to a 12% discount on auto insurance.

However, each company decides just how far in advance you need to sign up to receive the discount.

While most companies prefer at least 14 days, some offer savings for less time. Companies can also decide when an offer for discounted auto insurance needs to be claimed by.

Paperless Auto Insurance Discount

Many insurance companies offer a discount if you access your account through the app and get policy information online. Since most drivers prefer taking advantage of online options, discounts are usually around 5%.

Learn More: Best Auto Insurance Apps

Loyalty Auto Insurance Discount

Staying with your insurance company for multiple terms saves you money through the customer loyalty auto insurance discount. The required duration to qualify for the discount varies among companies.

While you can save 5% with a loyalty discount, not every company offers it. This is one of the best deals on auto insurance as policyholders are rewarded for loyalty.

Remember that the best way to save money is to shop around. So, although you may lose your loyalty discount, you may find much lower rates elsewhere.

New Customer Auto Insurance Discount

Switching auto insurance companies can mean lower rates and an extra one-time discount when you switch. However, Liberty Mutual is the only one that offers a new customer discount from top companies (Learn More: Liberty Mutual Auto Insurance Review).

In addition, some companies offer a discount of up to 12% for getting an online quote. Learn more about how to get a free auto insurance quote online.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Vehicle-Related Auto Insurance Discounts

You may be surprised to learn that your vehicle can also lower your rates. While auto insurance on new or expensive cars is higher, there are ways to save.

When looking for the best discount auto insurance, give accurate vehicle information to earn the most discounts. In addition, let your insurance company know if you’ve added features like an additional anti-theft device.

Many auto discounts only apply to your collision or comprehensive coverage. For example, comprehensive insurance covers a stolen vehicle — so anti-theft discounts only apply to that coverage. For more information, check out our complete guide titled, “Types of Auto Insurance.”

New Car Auto Insurance Discount

A new car auto insurance discount is readily available due to the abundance of safety features in modern vehicles, which effectively reduce the risk of accidents. This exclusive 15% discount is typically applicable to cars less than three years old.

Anti-Theft Auto Insurance Discount

Most cars now come with anti-theft features, such as VIN etching and car alarms, which can save drivers up to 25% on their auto insurance.

Remember, not all insurance companies offer identical discount amounts. For example, Geico auto insurance offers up to a 25% discount for the devices (Read More: Geico Insurance Review).

On the other hand, State Farm auto insurance discounts for anti-theft devices are as high as 15%. Check out our guide called “State Farm Auto Insurance Discounts” for a comprehensive State Farm discounts list.

GPS tracking programs like OnStar and LoJack reduce insurance rates because they help recover your vehicle if it’s stolen. Since your comprehensive insurance covers stolen cars, that’s where your discount applies.

Be sure to inform your insurance company if you install anti-theft devices aftermarket to get the discount.

Safety Features Auto Insurance Discount

Auto insurance companies understand that the safety features of your car save them money. Not only do these features keep you safe, but they also help you avoid an accident and reduce claims.

Some insurance companies offer a general safety feature discount, and others give up to 5% discounts for each feature individually.

Standard safety features include airbags, seat belts, daytime running lights, cameras, automatic braking, lane assists, electronic stability control, and antilock brakes.

Usage-Based Auto Insurance Discounts

How you drive your car can also lower auto insurance premiums. Many of the top auto insurance companies have usage-based insurance programs to award safe drivers up to 40% off their rates.

Typically, the insurer uses an app to track specific driving behaviors, such as speeding, phone use, acceleration, and hard braking. Then, you receive a discount based on how well you score.

You’ll find usage-based coverage and many other auto insurance discounts with Progressive, State Farm, Allstate, and Liberty Mutual.

Learn More:

- State Farm Drive Safe and Save Review

- Allstate Drivewise Review

- Liberty Mutual RightTrack Review

- Progressive Snapshot Review

This table shows usage-based auto insurance programs from top insurers and the saving amount offered.

Usage-Based Auto Insurance Discounts by Provider & Savings Amount

| Insurance Company | Program Name | Device Type | Sign-up Discount | Savings Potential |

|---|---|---|---|---|

| AAADrive | Mobile App | 15% | 30% |

| Drivewise | Mobile App | 10% | 40% | |

| KnowYourDrive | Mobile App or Plug-in | 10% | 20% | |

| DriveEasy | Mobile App | 20% | 25% | |

| RightTrack | Mobile App or Plug-in | 5% | 30% |

| Mile Auto | Neither | 20% | 40% | |

| SmartRide | Mobile App or Plug-in | 10% | 40% |

| Snapshot | Mobile App or Plug-in | $25 | 20% | |

| Drive Safe & Save | Mobile App or Plug-in | 5% | 50% | |

| TrueLane | Plug-in | 5% | 25% |

| IntelliDrive | Mobile App | 10% | 30% | |

| SafePilot | Mobile App | 5% | 20% |

Keep in mind that some insurers raise your rates if you score poorly. Although telematics can make you a safer driver with immediate feedback, you want to keep cheap insurance rates. For drivers with safe driving habits, usage-based discounts offer significant savings.

Best Auto Insurance Companies for Discounts

There are many different ways to get discounts on auto insurance. When it comes to auto insurance, there isn’t a one-size-fits-all solution. Instead, your personal characteristics determine your rates and discounts. Additionally, each auto insurance company determines discount amounts.

To get started, the map below shows the average full coverage auto insurance rates by state:

This table shows auto insurance discounts from top insurance companies. Remember, not all insurance companies offer the same discounts, so look carefully to see which insurer can provide you with the most savings:

Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $47 | $124 | |

| $52 | $133 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

Compare discounts and rates when shopping for auto insurance. Discounts may determine which company is cheaper for you.

Read the fine print when looking at discounts — some discounts are up to a certain percentage, meaning you may not qualify for the total discount. Also, auto insurance companies don’t automatically apply discounts to your policy, so you may have to ask for specific discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tips to Get the Cheapest Auto Insurance With Discounts

Add discounts to your auto insurance policy to get significantly cheaper rates. There are also other ways to get the lowest auto insurance rates available.

First, shop around. As we discussed, each company offers different discounts and rates. Compare multiple companies to find your cheapest auto insurance.

Next, learn what discounts are mandatory and available for you in your state. Then, ask for all eligible discounts, and bundle them for the most savings.

Since not all discounts are automatic, you need to know what you’re eligible for and what your state requires. For example, all insurers in Louisiana must offer active duty military personnel a 25% military discount, according to the Louisiana Department of Insurance.

Remember, many discounts are up to a certain amount and don’t apply to your entire policy. For instance, some discounts only apply to comprehensive auto insurance coverage. So pay careful attention to the discounts your auto insurance company offers to know precisely how much you’re saving.

Also, change your personal factors to get the lowest auto insurance rates. For example, improve your credit score and keep your driving record clean to get lower rates. You can also lower coverage and raise auto insurance deductibles to get the cheapest coverage possible.

In addition, think carefully when you buy a new car. You might wonder whether the age of a car affects auto insurance rates. Newer or more expensive cars have higher auto insurance rates since repair costs are higher.

Finally, make changes to your policy to add more discounts. So should I pay my auto insurance in full? Pay in full, go paperless and renew early to save even more. See what auto insurance discounts your insurer offers and learn how to take advantage of as many as possible.

To discover more about the company, visit our guide titled, “How to Get a Persistency Auto Insurance Discount.”

How Auto Insurance Discounts Can Help to Lower Your Auto Insurance Premium

Discounts are an easy way to get cheap auto insurance rates if you’re struggling with expensive coverage. For example, discounts can bring your rates down to normal if you have high rates due to a bad driving record.

Found yourself in trouble while driving?😱You might be worried your insurance rates will skyrocket!🚀But don’t worry, at https://t.co/27f1xf131D, we’re here to help you find the best rates, even with instances like a DUI. Find out more here👉: https://t.co/BN5jVycT7Z pic.twitter.com/cnOQXb44uK

— AutoInsurance.org (@AutoInsurance) May 2, 2023

auto insurance companies typically base discounts on the driver, policy, and vehicle. Most insurers allow you to bundle eligible discounts for the most significant savings. When shopping for insurance, compare discounts and rates. Every insurance company offers different discounts, and the discount amount also varies.

Common types of auto insurance discounts include safe driver, good student, multi-car, and occupational discounts. Many top insurance companies also offer usage-based discounts, which use telematics to monitor specific driving habits. How safely you drive determines your discount. Shop around and obtain quotes for auto insurance for the most affordable prices.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

Frequently Asked Questions

What are the top six auto insurance discounts you should ask about?

If you’re looking for auto insurance discounts, consider these six options offered by most top insurers that benefit many drivers:

- Multi-Policy Discount

- Good Driver Discount

- Good Student Discount

- Multi-Car Discount

- Safety Features Discount

- Low Mileage Discount

However, you should speak with your insurance company to see what other discount options are available for your situation. Learn more about how to lower your auto insurance costs.

How can I save more money on my auto insurance?

A top question readers ask is, “Can I get a lower rate on my auto insurance?” Auto insurance discounts are a great way to get affordable premiums, offering savings of up to 40% in some cases. You can also increase your deductible, avoid at-fault accidents, drop unnecessary coverages, and insure an older vehicle for cheaper rates.

What are the best auto insurance discounts?

The best deals on auto insurance vary by driver. The most significant savings typically come from safe driver discounts, but not everyone has a good driving record. While one driver qualifies for a safe driver discount, another may only be able to take advantage of vehicle discounts. Putting in some research can help you figure out which auto insurance discounts to ask for.

The best way to save with discounts is to bundle them. Bundling your discounts may also save you on other insurance products, like homeowners, renters, and boat coverage.

How much is a good student discount for auto insurance?

Drivers can save up to 25% with a good student discount if the student maintains at least a B average while enrolled in school full-time and is under 25. Young drivers can bundle the good student and driver’s education discounts for the most savings.

Who gives the lowest auto insurance rates?

USAA offers the cheapest auto insurance rates of the top companies, averaging $59/mo, but only military members, veterans, and their family members qualify.

The next most affordable insurers are Geico and State Farm, offering average rates of $80/mo and $86/mo, respectively. However, your auto insurance quotes vary by factors like age, gender, driving record, and discount eligiblity.

Check out our expert guide titled “Geico Auto Insurance Discounts” to learn more.

Can I get a discount for bundling auto insurance with other policies?

Most auto insurance companies offer bundling discounts to drivers who have other types of insurance products with the same company, helping to lower your auto insurance premiums.

Are there auto insurance discounts for installing anti-theft devices in my car?

Many auto insurance companies discount policyholders for installing anti-theft devices in their car, like alarms, immobilizers, or tracking systems. These devices reduce the risk of theft, leading to lower auto insurance premiums.

Do insurance companies offer discounts for low mileage on auto insurance?

Yes, you can get auto insurance discounts for low mileage from some insurers. Read more about auto insurance for limited use.

Can I get a good driver auto insurance discount?

Yes, many companies offer an auto insurance discount if you maintain a good driving record free from accidents or traffic violations.

Discover more by exploring our in-depth guide titled, “How long does an accident stay on your record?“

Are there any auto insurance discounts for students or young drivers?

Yes, auto insurance discounts like good student, multi-car, and driver’s education discounts can benefit young drivers. Read more about how to buy the best auto insurance for college students.

Are there any auto insurance discounts for nurses?

Geico, Liberty Mutual, and Nationwide offer affiliation discounts on auto insurance, which include many nurses and health care professionals. Speak with your insurance company directly to see if you qualify.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

At what age is auto insurance cheapest?

Generally, you’ll see the cheapest auto insurance rates in your late 50s to early 60s. Most insurers consider drivers within this range as experienced and low risk, so they charge lower rates.

Which insurance company offers the mosts discounts?

You can usually find the most discount options with Allstate, State Farm, and Liberty Mutual. However, having the most discounts doesn’t mean you’ll get the cheapest rates. So, insert your ZIP code into our free quote comparison tool below to know exactly what you’ll pay after discounts.

Can auto insurance be negotiated?

In most cases, auto insurance premiums can’t be negotiated since they’re based on factors such as driving record, location, and coverage type. However, you can get cheaper rates by asking for insurance discounts, increasing your deductible, or getting rid of unneeded coverages.

Is Geico cheaper than Progressive?

Geico usually has more affordable auto insurance rates than Progressive accross various driver demographics and profiles. While full coverage insurance with Progressive costs around $105 monthly, it’s only $80 with Geico.

Are there any hidden Progressive discounts to lower my rates? Yes, some of Progressive’s lesser-known discounts include the Snapshot program, the homeowner discount, and the paperless discount.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.